Take the stress out of parenting and put your mind at ease with a professional tutor.

Online GCSE & KS3 Tutoring That Works

Our Offer

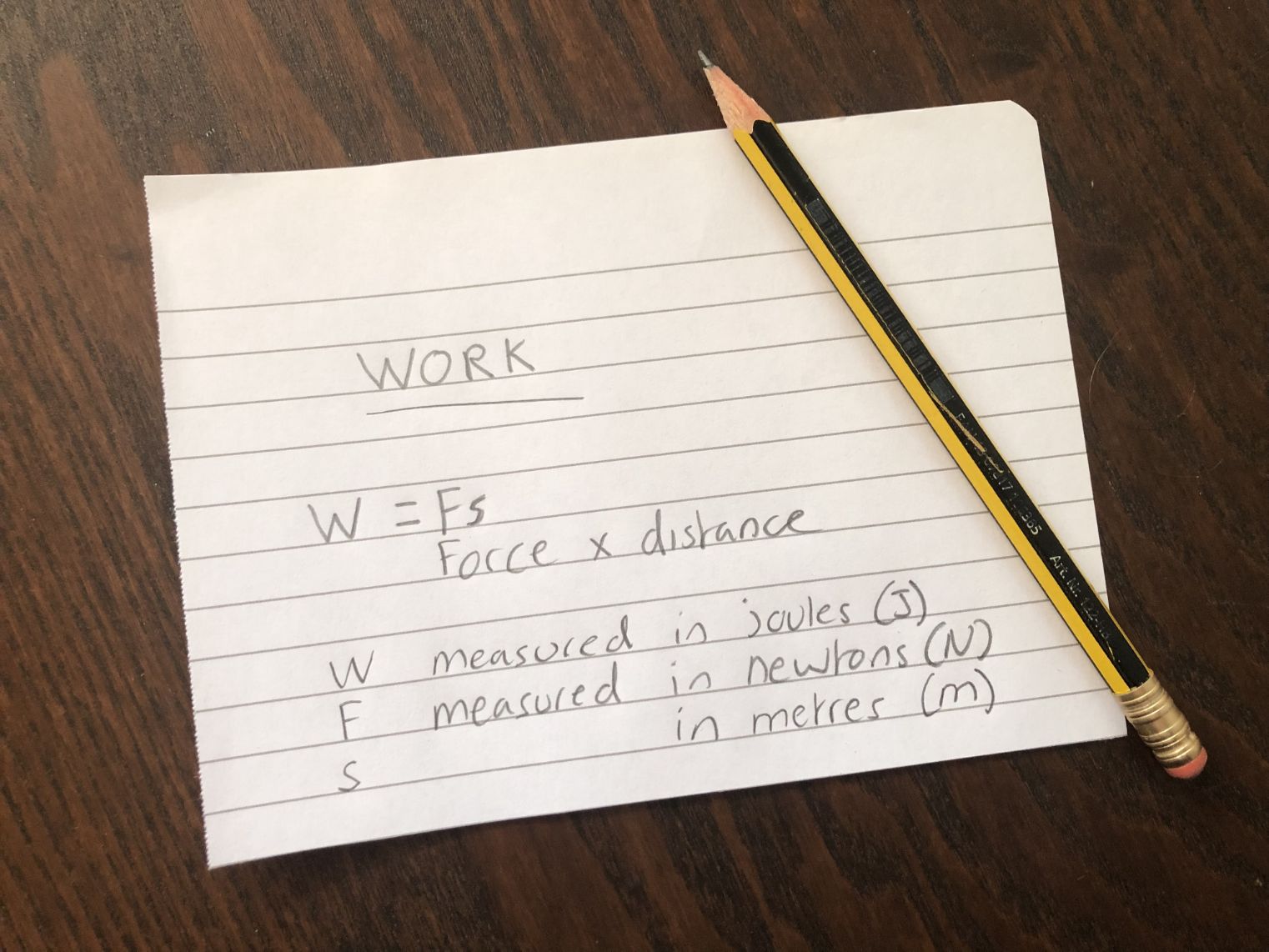

Maths and Science Tuition by Experienced Tutors

- Exploring New Topics

- Revision and Study Strategies

- Past-Paper Practice

- Exam Preparation

- Confidence Building

- Personalised Learning Plans

Questions? Use the form, and expect a quick reply!

Feedback From Parents

Contact Us

Online Maths and Science Tutoring Services

What is Inquiry Based Learning?

Inquiry-based learning is an approach to teaching that connects experts with students but in a flipped way, where students are expected to contribute more to sessions than they normally would. Students might be asked questions and together the teacher and student can discuss the question to understand more deeply what the implications of the answers are. The goal is to engage students in a way that normal teaching does not achieve and for students to gain curiosity in the subject matter. Curiosity is an internal feeling which drives us to explore and learn and this is what students should feel when studying a new topic. Higher levels of curiosity have also been linked to increased attention which leads to improvements in information retention and memory. If you want to find out more about how curiosity, attention and memory affect learning, Contact us and we can direct you to the relevant research.

Why do we use Inquiry Based Learning?

We use inquiry-based learning as an introduction to a new way of doing things. We aim to provide a different experience where we can help students to learn about what they are interested in. Any subject can be made exciting through the correct approach and conversely, the most interesting subject can be made boring by traditional you listen, I talk teaching. We believe that inquiry-based learning can also be used as a tool for assessment whereby a students progression can be tracked through their ability to understand, interpret and use logic to communicate their ideas. We provide regular updates on students’ progress and through sessions with us you can expect not only an improvement in grades but also an increase in confidence across the board. Communication is key and inquiry-based learning is unrivalled in its ability to engage and promote active interactions with students. If you want to find out more about how we can help students, Contact us now.